Summary

Highlights

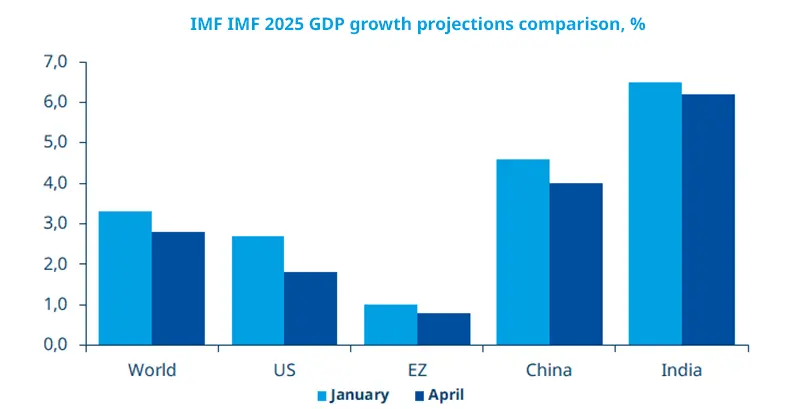

- The recent IMF downgrade highlights how policy ambiguity could hurt global trade and economic activity.

- The IMF raised inflation forecasts only marginally for this year; we think the disinflation trend should continue in medium term.

- In such a context, the central banks’ task becomes difficult as they try to balance supporting growth and fighting inflation.

In this edition

In its latest release, the IMF has slashed its global growth forecast compared to January, owing to the trade war and policy uncertainty unleased by the United States. 2025 global GDP growth is now seen at 2.8%, down from 3.3%, while for next year it is expected at 3.0%. Growth projections were cut across the board, with the United States having a sharp downgrade to 1.8% for 2025. We are more cautious on US growth amid concerns over consumption. European growth was not affected as much in the recent IMF projections. Germany is expected to show almost flat growth this year, following two annual contractions in 2023 and 2024. We forecast a mild expansion for the German economy this year. China was also downgraded, as the economy will be hit by external pressures from the United States.

Source: IMF, Amundi Investment Institute, as of 23 April 2025.

Key dates

30 Apr GDP - US, Euro Area, Mexico; US PCE | 1 May Bank of Japan policy rate, UK consumer credit | 2 May US labour data, Euro Area CPI, India PMI |

*Diversification does not guarantee a profit or protect against losses.

Read more