Summary

Key takeaways

January’s end brought a bout of extreme volatility across commodity markets. Several commodities appear to have been hit by a correction after short-term euphoria, likely prompting the unwinding of speculative positions at month-end in silver, platinum, tin, US natural gas (NG) and the euro.

Silver tumbled about 26% on Friday, January 30, and US natural gas suffered a similar decline on Monday, February 2. As a result, volatility in precious metals and gas has surged to more than double its historical levels.

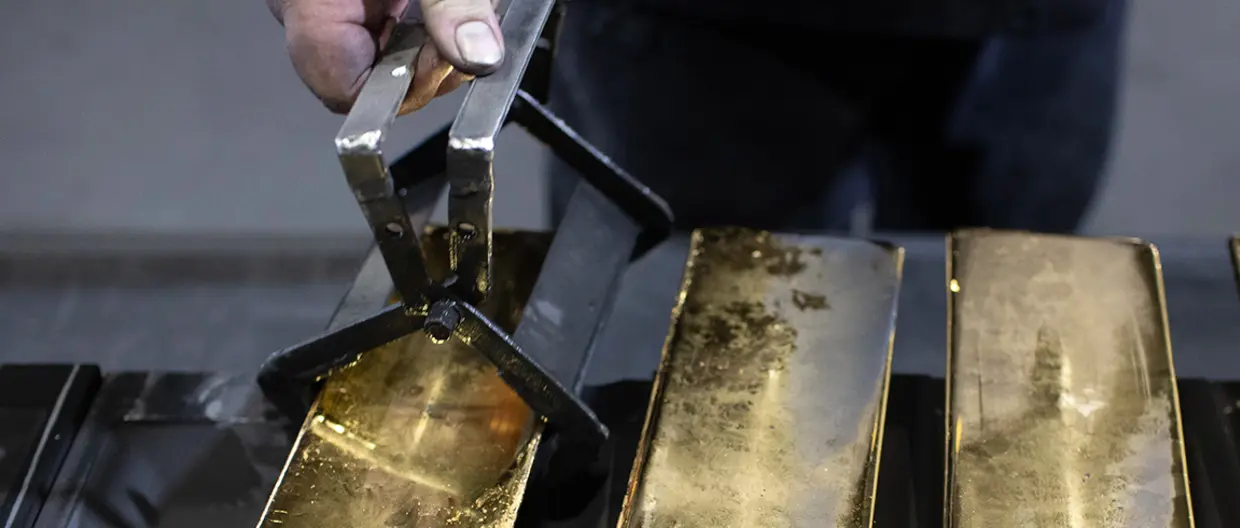

Gold, silver, copper and oil are reacting to a mix of structural demand shifts, geopolitical risk and short-term speculation. While central bank buying and safe-haven flows underpin gold, silver’s rally is partly explained by a near-term supply deficit and industrial demand. Copper faces a long-term structural gap driven by electrification and the AI buildout, and oil remains exposed to asymmetric geopolitical tail risks.

A balanced barbell strategy, combining gold with industrial metals exposure, plus a modest allocation to alternatives, can improve portfolio resilience.

Read more