Summary

Highlights

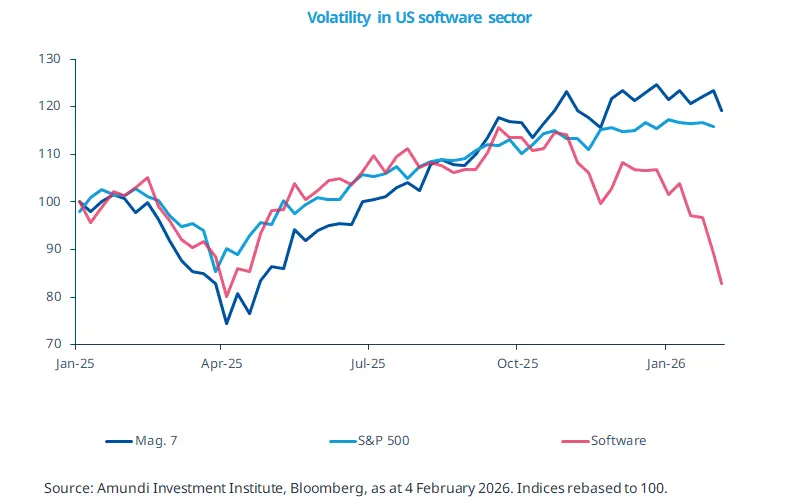

US software stocks declined about 20% YTD as on 4 Feb, due to concerns that advancement in AI would impact businesses of some companies.

This also suggests that the market expects clearer evidence on the potential returns from the substantial AI investments.

While winners of today may be different from tomorrow, companies that allocate capital in a disciplined manner should emerge as long-term winners.

In this edition

The tech revolution's impact on different parts of the economy and society is unquestionable. The sell-off in American software companies - tiggered by newsflow around an artificial intelligence-led (AI) productivity tool that could affect some software companies - is a reflection of this structural trend. Near term, this is the market’s way of demanding clarity on the massive AI investments companies are making. But this may not necessarily be a verdict on their business models. What’s clear is that markets would increasingly differentiate companies that provide more clarity on financial benefits of AI investments from those where the return potential is ambiguous. This was also evident after the corporate earnings of some large tech companies were released. Additionally, the volatility in markets in areas of ‘consensual trades’ affirms our view that diversification* is crucial in these times.

*Diversification does not guarantee a profit or protect against a loss.

Key dates

EZ Sentix investor confidence, NY Fed inflation expectations |

UK GDP, India CPI |

EZ trade balance and employment, US CPI |

Read more