Summary

Highlights

In Davos, Canadian PM Carney warned that mid‑sized countries must develop a system to replace the US‑centric global order.

One year after Trump's inauguration, geopolitical risk is back in focus, along with the need to hedge against it.

Diversification* away from US assets will be driven by structural trends, such as rising US deficits and global central banks diversifying their reserves into non‑dollar‑denominated assets.

*Diversification does not guarantee a profit or protect against a loss.

In this edition

The global equilibrium is evolving, particularly amid significant geopolitical shifts that are causing increased volatility in financial markets. President Trump's threat to impose additional tariffs on eight NATO members — unless the United States were allowed to purchase Greenland from Denmark (a threat that was withdrawn a few days later) — initially caused a short market sell‑off, followed by a relief rally last week. Meanwhile, the European Parliament voted to suspend ratification of the EU‑US trade deal, which would otherwise have come into force on 7 February. This does not mean the deal is dead, but that Europe is adopting a 'wait‑and‑see' approach.

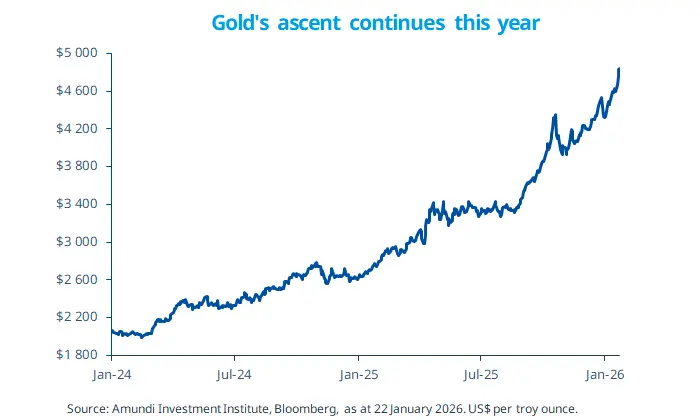

These — and likely future — developments may lead to high and persistent market volatility. Therefore, global investors should maintain a diversified approach with safeguards such as gold, whose price hit a new all‑time high last week.

Key dates

26 Jan Germany IFO business climate, US durable goods orders |

28 Jan Fed interest rates decision, Brazil interest rates decision |

30 Jan EZ GDP growth and unemployment rate, Germany inflation |

Read more